Paytm and Inox face FIR for charging illegal fees: RBI and MeitY observe violation of regulations.

Paytm and multiplex chain major Inox have been facing an FIR in Hyderabad over exorbitant and illegal charges levied by both companies. A social activist Vijay Gopal highlighted that they are charging payment gateway fee on consumer transactions without proper authorisation in the FIR.

According to Gopal, Paytm is a booking gateway for movie tickets and can’t charge for a convenience fee, booking charges, and cancellation charges. In his complaint, he mentioned, “The levying of such charges is illegal as it has not been authorised by the RBI.”

Citing a personal anecdote, Gopal mentioned in the FIR that he purchased two tickets that have a real cost of Rs 276. However, he was charged Rs 80 extra under cancellation protection, convenience as well as booking fees, as per The News minute report.

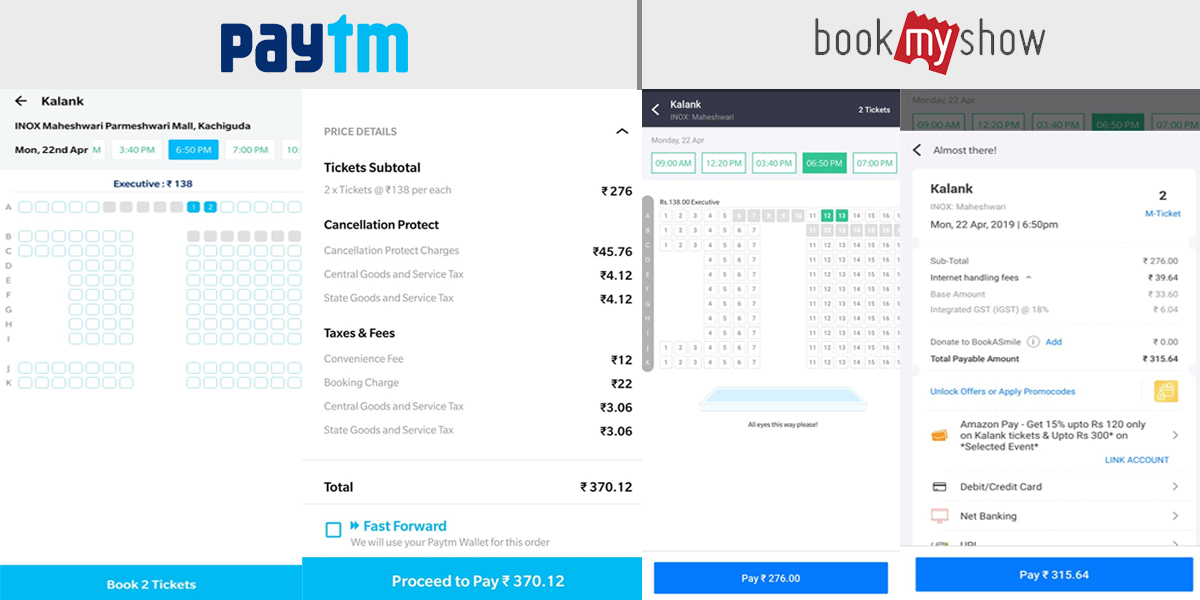

To understand more about Gopal’s claim, Entrackr has tried booking tickets through Paytm in the same multiplex (Inox- Maheshwari, Kachiguda). We found that while booking two tickets Paytm is charging Rs 94 extra for cancellation protection, convenience, and booking charges.

Meanwhile, we also booked tickets via BookMyShow in two Inox in Hyderabad (Inox Banjara Hills and Inox Maheshwari) for the same movie. Unlike Paytm, BookMyShow didn’t charge any extra fee. Clearly, Paytm has been charging users more than rivals.

While we didn’t find any extra charges levied by BookMyShow, some readers pointed out that it does charge convenience fees.

Infuriated over illegal charging, Gopal asked RBI and ministry of Electronics and Information Technology whether they have authorised Paytm to levy a payment gateway charge on consumer transactions or not. In response, they denied approval to any merchant, online trader, or e-commerce company for levying such fees.

Paytm sold 52 Mn entertainment tickets in 2017, claims 6X growth but how,

Entrackr has sent detailed queries to Paytm and Inox. A separate query also sent to MeitY. We will update the post as and when they respond.

The reply further explains that this is a violation of the RBI’s Merchant Discount Rate (MDR). MDR is the cost levied from consumers by a merchant on behalf of the bank for accepting payment via credit or debit card.

A service provider cannot charge extra for the service it provides to consumers unless the service charge has been authorised by the appropriate government as per section 6 A(3) of the IR (amendment) Act 2008.

Factoring responses of government and apex banking body, Paytm appears to be violating government and RBI guidelines. Since Paytm and Inox can only clear the air on this matter, it would be observed how they respond to FIR and exorbitant charging claims. Also, regulators are likely to take some measures and may penalise both firms on the issue.

Connect with us